Mystery celeb memecoin scam factory, HK firm dumps Bitcoin: Asia Express

- Cryptomonaie

Noesis News

Noesis News- mars 7, 2025

- 0

- 2

- 22 minutes de lecture

Rumored Shenzhen celeb memecoin factory

A mysterious memecoin factory in Shenzhen is rumored to be behind a wave of memecoin scams, allegedly launching over a dozen tokens a month. Brazilian football legend Ronaldinho Gaúcho has been swept into the controversy on Chinese social media.

On March 3, Ronaldinho announced the launch of his own memecoin on BNB Chain. Within hours, it skyrocketed to a peak market cap of $30 million, only to come crashing down to around $3.7 million, according to CoinGecko data.

A now-banned X user, @R10coin_, claimed to have struck a $6 million deal with Ronaldinho to promote their token, paying him $3 million upfront. However, the X user then claimed Ronaldinho had allegedly signed another token deal and that the footballer’s X account had been sold to a Shenzhen-based firm.

The unnamed Shenzhen firm is rumored to operate like a full-scale scam operation, aggressively marketing celebrity-backed tokens to lure investors, pumping the price, and then cashing out before disappearing. These unverified accusations, while speculative, have ignited discussions across Chinese crypto communities about the presence of organized memecoin factories designed solely to rug unsuspecting investors.

A legal expert from Man Kun Law Firm weighed in on the matter through a WeChat post on March 4. The lawyer stated that if such “token factories” truly exist, they would constitute outright fraud and a textbook example of a rug pull. According to the lawyer, the marketing is based entirely on deception — using famous names to create hype, playing into people’s fantasies of overnight wealth, and ultimately profiting off artificial price manipulation rather than developing a genuine blockchain project.

Despite all these allegations, the project itself has not been abandoned, though its value has mostly evaporated. On March 6, the Ronaldinho memecoin team announced that the token would be expanding to the Solana blockchain, doubling down on its future plans rather than distancing itself from the token. Meanwhile, the X account that raised accusations against Ronaldinho and the supposed Shenzhen factory, @R10coin_, has been banned from the platform for violating site policies.

Not all HK-listed Bitcoin buyers are hodling

Another Hong Kong-listed company has been buying Bitcoin — but don’t get too excited. Yuxing Infotech Investment Holdings (HKEX: 8005) quietly accumulated millions in BTC in the second half of 2024, only to begin selling just months later.

According to disclosures filed with the Hong Kong Stock Exchange, Yuxing purchased 78.2 Bitcoin between July 25, 2024, and Dec. 31, 2024, at an average price of $80,960 per BTC, amounting to a total of $6.3 million. But by early 2025, the firm had already started reducing its holdings. Between Jan. 22 and March 5, Yuxing sold 50 BTC at an average price of $89,194 per coin, generating $4.5 million. The company also offloaded 3.3 million USDT for $3.3 million.

Yuxing has not outlined a long-term strategy regarding Bitcoin. While the firm allocated capital into BTC in 2024, it opted to reduce its holdings within months, suggesting it may view Bitcoin as a short-term investment rather than a treasury asset. The sales at $89,194 per BTC indicate Yuxing may have turned a profit, though the company did not provide details.

Yuxing is not an outlier among Asian firms. In December 2024, Chinese selfie app Meitu liquidated its entire Bitcoin and Ethereum holdings, securing approximately $80 million in profits after three years of accumulation.

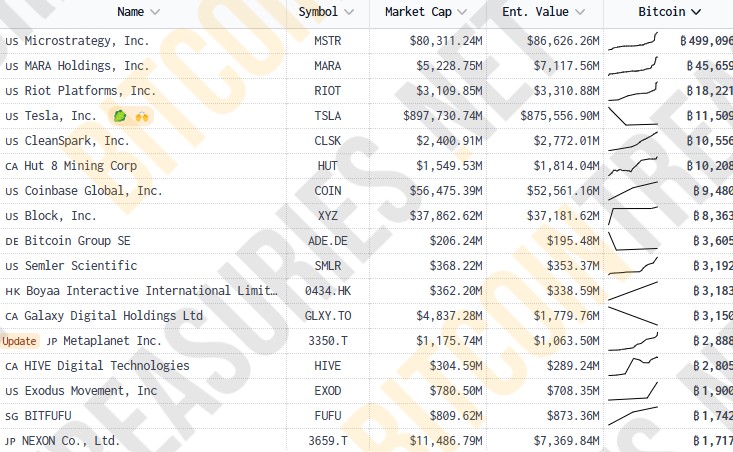

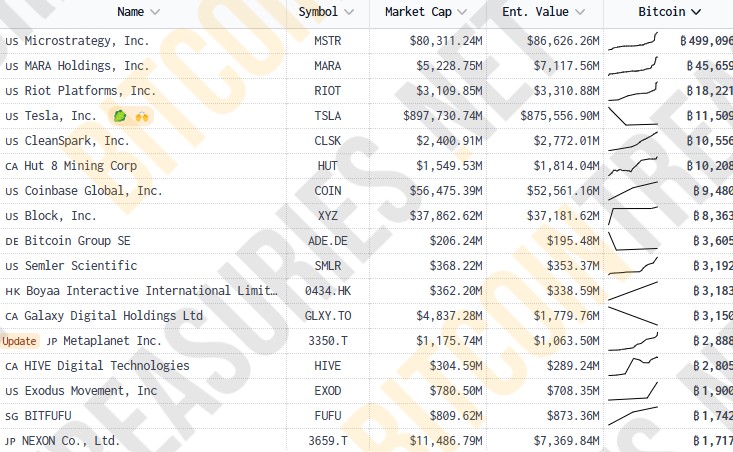

Meitu was once called the “MicroStrategy of Asia”, being one of the first firms to adopt the aggressive Bitcoin accumulation strategy popularized by Strategy and its CEO Michael Saylor. That title has since shifted to Japanese investment firm Metaplanet, which is now closing in on Hong Kong-listed Boyaa Interactive, Asia’s largest public Bitcoin holder with 3,183 BTC.

On March 5, 2025, Metaplanet increased its holdings to 2,888 BTC after purchasing another 497 Bitcoin.

Read also

Telegram in crosshairs in Singapore as crypto and AI crimes surge

Singapore is raising concerns over Telegram’s role in scams, with Minister of State for Home Affairs Sun Xueling warning that the messaging platform’s emphasis on user anonymity has made it attractive to scams and other criminal activities. Authorities are monitoring the platform closely after the number of scams linked to Telegram nearly doubled in 2024.

“One platform we are especially concerned about is Telegram, which has long prioritized and even prided itself in, the anonymity that it provides its users. This anonymity is exploited by scammers and other criminals,” Sun said in a speech on March 4.

Scam tactics are also evolving. With tighter security measures in place for banking transactions, fraudsters have increasingly shifted to cryptocurrency, where funds are harder to track and recover. Crypto-related scams accounted for nearly a quarter of all scam losses in Singapore in 2024, up from less than 10% the previous year. The single largest scam of the year — totaling $125 million — was a malware-enabled attack on a victim’s cryptocurrency wallet. While Singapore has licensed some digital payment token service providers, Sun noted that many foreign crypto exchanges and wallet providers remain unregulated and beyond the reach of local law enforcement.

Authorities are also warning about the rise of AI-driven scams, which have made fraud more difficult to detect.

“Gone are the days when we could easily spot a scam call or email, through heavy foreign accents or bad English. Today, scammers use AI and information about us online, among other capabilities, to make themselves more believable and evade easy detection,” Sun said.

Scammers now use AI-generated voices and information from social media to create more convincing deception tactics. Singapore has responded by deploying AI-powered scam detection tools, such as the Scam Analytics and Tactical Intervention System, to identify and disrupt fraudulent websites and accounts more efficiently.

The government is assessing whether further measures are needed to address scams on Telegram. Sun said authorities will explore additional actions and may consider “legislative levers” if necessary. The government has already worked with platforms such as Meta and Carousell, which introduced enhanced identity verification measures that led to a significant drop in e-commerce scams.

Read also

Japan warms up to stablecoins

SBI VC Trade is preparing to become the first Japanese financial platform to offer USDC stablecoin transactions, following the completion of an initial regulatory registration, as Japan gradually relaxes its stance toward stablecoins.

On March 4, SBI VC Trade announced it had completed the initial phase of registration for stablecoin trading, receiving approval from the Kanto Regional Financial Bureau’s Tokyo office. This registration allows SBI VC Trade to start offering USDC transactions to select users from March 12, with plans for broader public availability shortly afterward.

The move follows Japan’s recent easing of stablecoin regulations. In 2023, Japan reportedly lifted a ban that had restricted foreign-issued stablecoins. In February 2025, Japan’s Financial Services Agency (FSA) approved recommendations by a working group to further relax regulations around stablecoin use, signaling the government’s growing support for stablecoins as tools for financial innovation and efficient transactions.

SBI VC Trade, a subsidiary of financial giant SBI Holdings, has a longstanding presence in the crypto market, notably through its collaborations with firms like Ripple.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan Yun is a multimedia journalist covering blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has covered Asian tech stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.