Best Crypto Staking Platforms for Highest Rewards in 2025 – CryptoNinjas

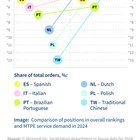

The best crypto-staking platforms are Binance, Coinbase, Solaxy, BTC Bull, Kraken, Bybit, Gemini, KuCoin, and Crypto.com. These are websites or apps where you can lock up your cryptocurrency assets to support blockchain networks and earn rewards in return. These crypto-staking sites are intermediaries allowing you to participate in staking without running your validator nodes.

To decide the best places to stake crypto, you need to consider factors such as security measures, staking rates, supported coins, types of staking, staking fees, ease of use, and reputation and reliability.

In this guide, we will review the 9 best crypto staking platforms based on the abovementioned criteria. We will also cover what crypto and Bitcoin (BTC) staking services are, what the benefits and risks of crypto staking are, and how to start staking crypto. Lastly, we will also cover how to choose the best places to stake your crypto and Bitcoin.

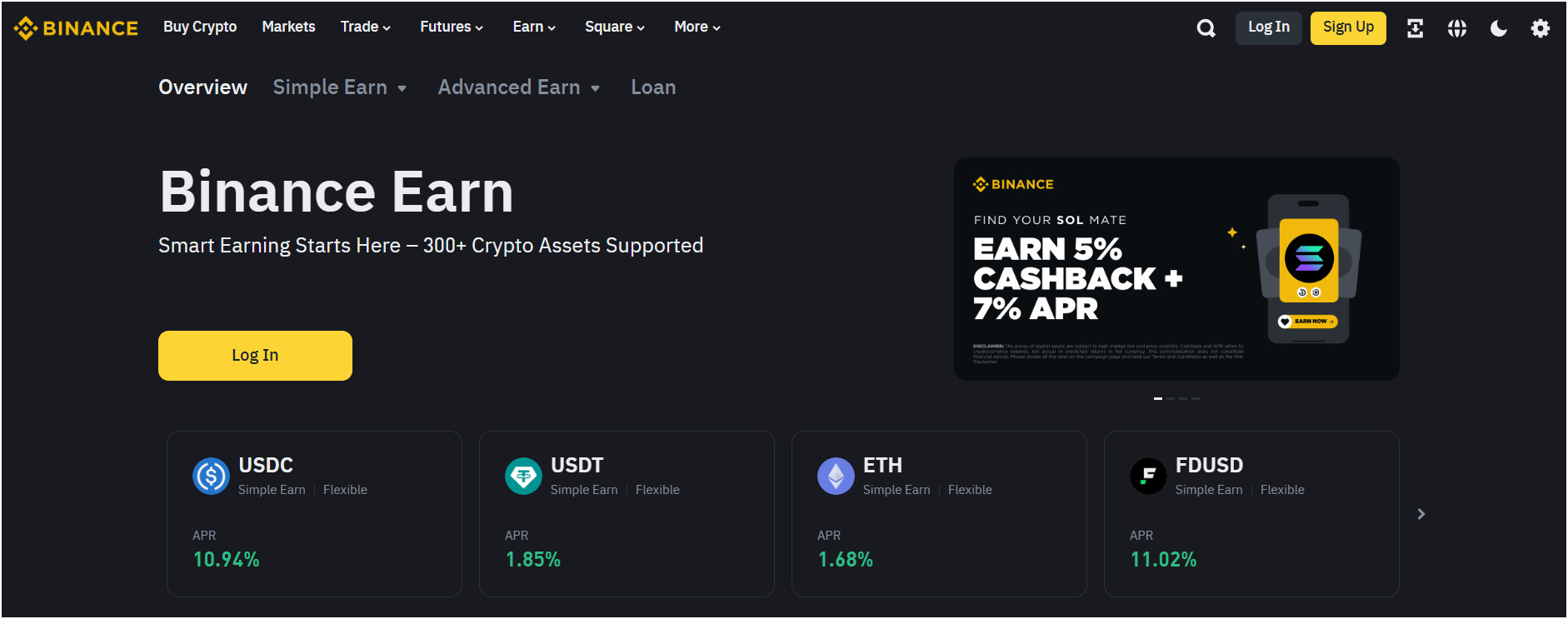

1. Binance

Binance is the best crypto-staking platform on our list. It was established in 2017 by Changpeng Zhao and now providing servies to more than 250 million users from 180+ nations. It has the most trade volume globally. There are several Binance earning and staking products.

The platform provides locked staking, where you can lock in your funds, such as BNB, ETH, etc., for 30, 60, or 90 days to receive high rewards. For certain assets, annual percentage yields (APYs) reach as high as 100% with locking staking service on Binance. This staking platform also provides flexible staking, allowing you to withdraw your staking assets at any time but with lower APYs.

Binance’s Simple Earn service backs yields on 300+ coins, including BTC and stablecoins such as USDT. Binance doesn’t take staking commissions from global users; however, if you happen to be a US user, then Binance.US takes a maximum of 25% in staking commissions.

BTC Staking Rates: Binance Bitcoin staking rates are 0.27% APY in simple Earn and gain up to 179% APY in dual investment.

Number of Supported Staking Coins: Binance currently supports staking for over 300 cryptocurrencies. These coins include ETH, SOL, BNB, ADA, and MATIC, among some other low-cap altcoins.

Pros of Binance

- Binance offers over 300 staking options for diverse portfolios

- You earn up to 100% APY with locked staking plans

- The platform provides flexible staking with no lock-up period

- Security includes the SAFU fund and 90% cold storage protection

Cons of Binance

- Binance.US charges up to 25% commission on staking rewards

- Fewer staking options for U.S. users compared to global

Join Binance today and maximize your earnings with premium staking benefits

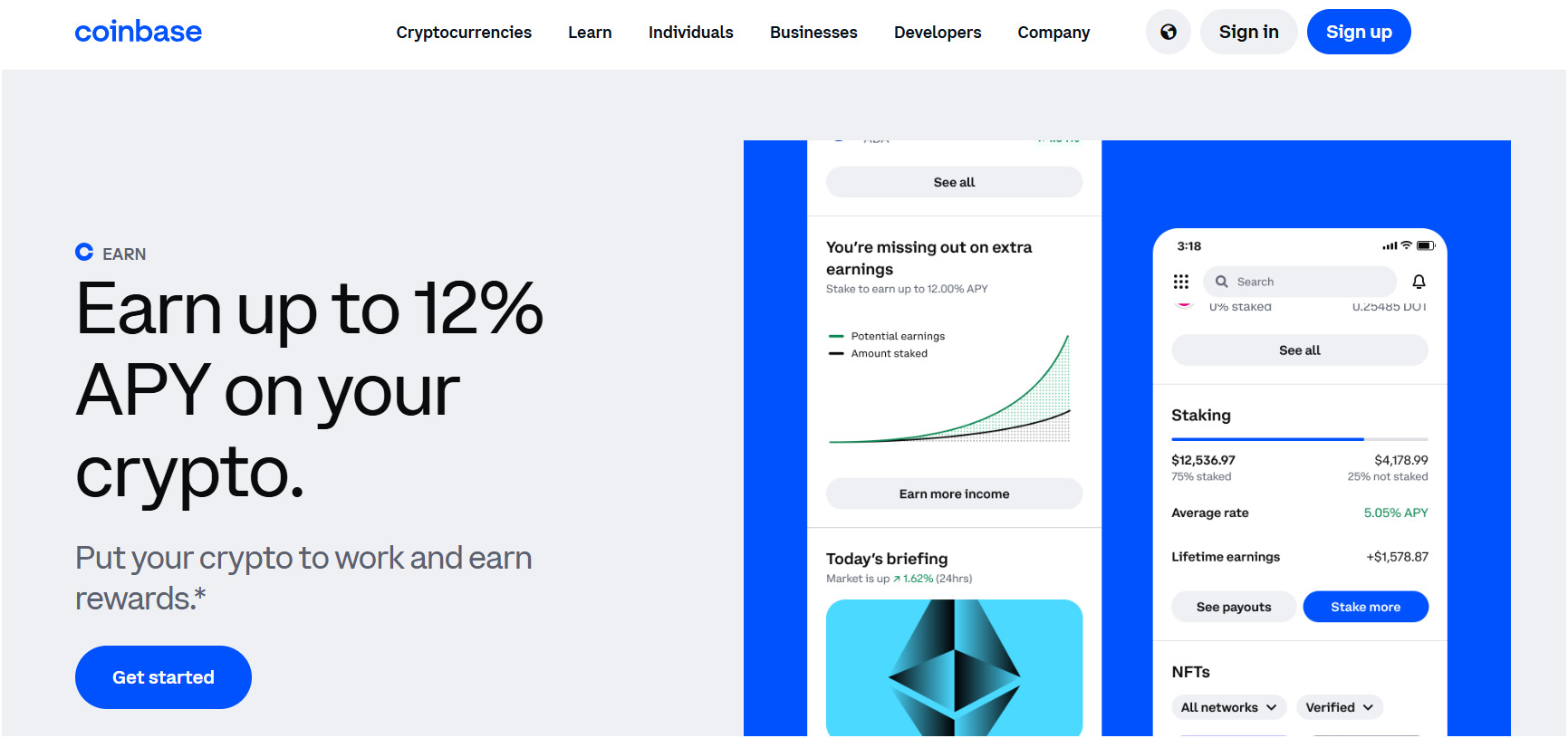

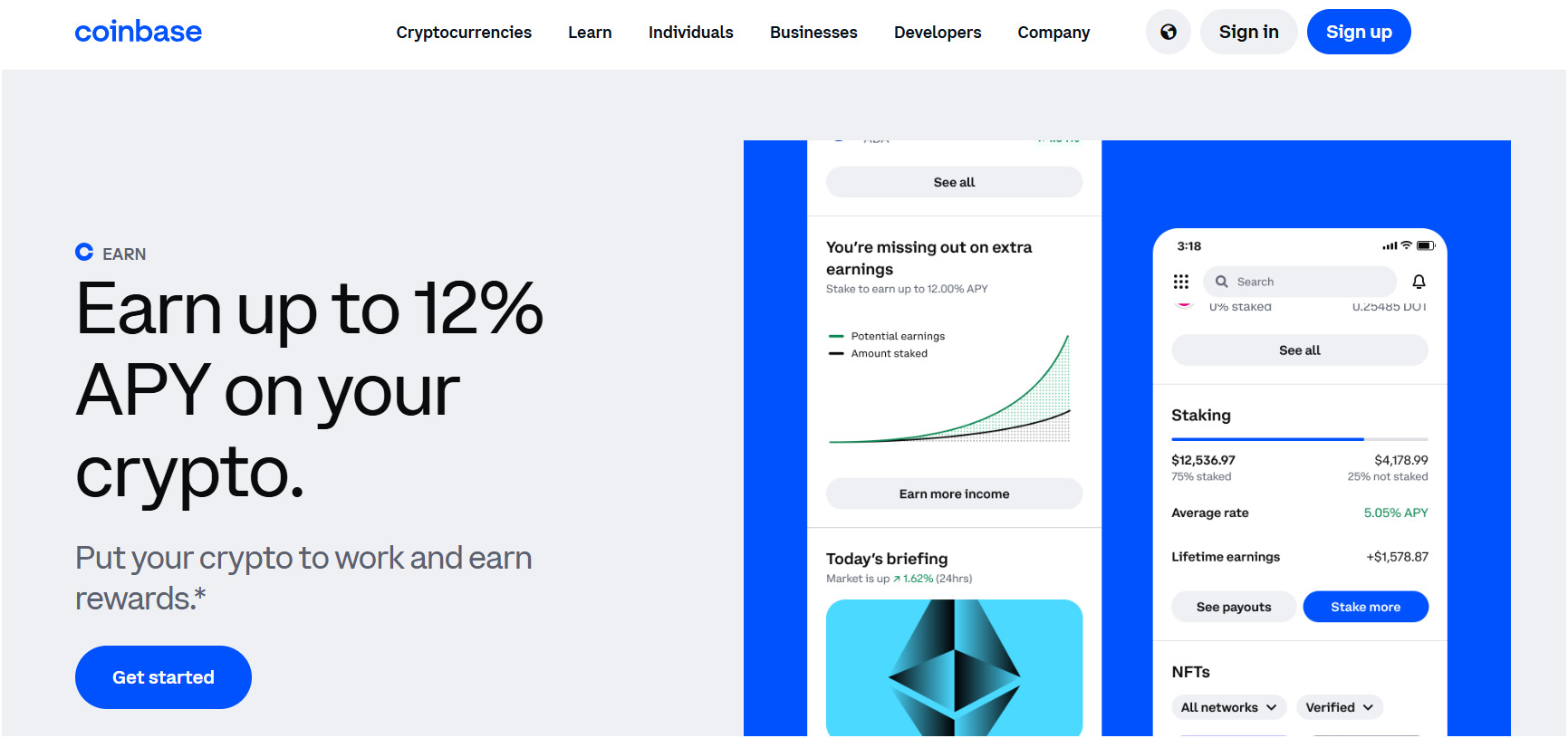

2. Coinbase

Coinbase is the safest crypto-staking platform in the United States. It serves over 100 million users and offers a user-friendly platform for buying, selling, and staking digital assets. Coinbase has multiple products for different user types, including Coinbase (for beginners), Coinbase Pro (for advanced trading), and Coinbase Prime (for institutions).

Coinbase staking allows you to earn rewards just by holding proof-of-stake cryptocurrencies like Ethereum and Solana. You can stake with a simple opt-in process using the mobile app. It handles all the technical validation on your behalf, so you need to pay a 25% commission on rewards.

Also, the Coinbase Earn program offers another avenue, paying users between $1 and $15 in any crypto for watching some educational videos and then completing quizzes. Staking is generally available in most regions, though currently, it is restricted in states like California due to some regulatory issues.

Staking Rates: Coinbase does not offer BTC staking. As you know, Bitcoin uses proof-of-work, not proof-of-stake. But you can stake ETH with a 2.31% APY.

Number of Supported Staking Coins: Coinbase currently supports staking for 140 cryptocurrencies, including Ethereum, Solana, and Cardano.

Pros of Coinbase

- Offers staking for 140+ popular cryptocurrencies like ETH and SOL

- Easy opt-in staking process via mobile app for all users

- High security with cold storage for 98% of user assets

- Coinbase Earn pays users up to $15 for learning about crypto

Cons of Coinbase

- Coinbase charges a high 25% commission on your staking rewards

- Bitcoin staking is currently unavailable

- Staking is restricted in 10 U.S. states, like California

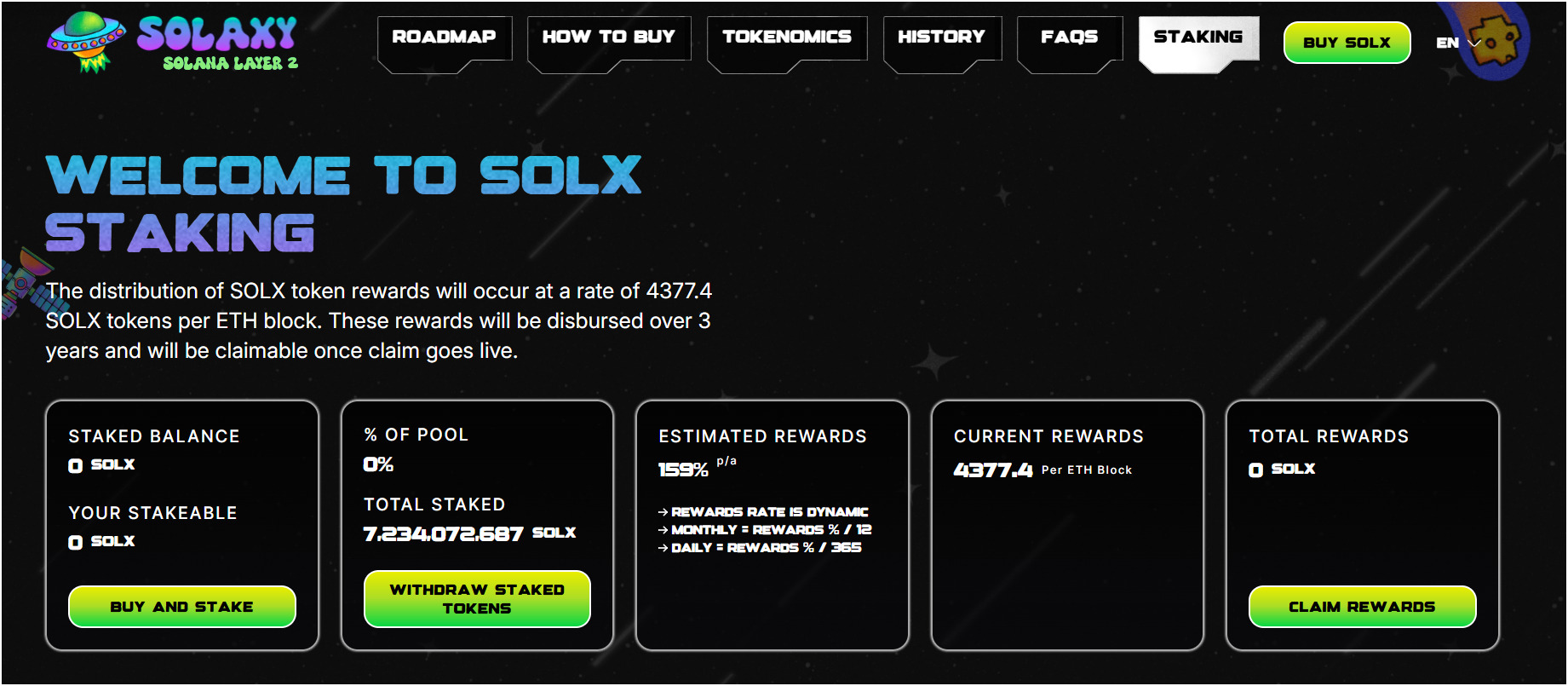

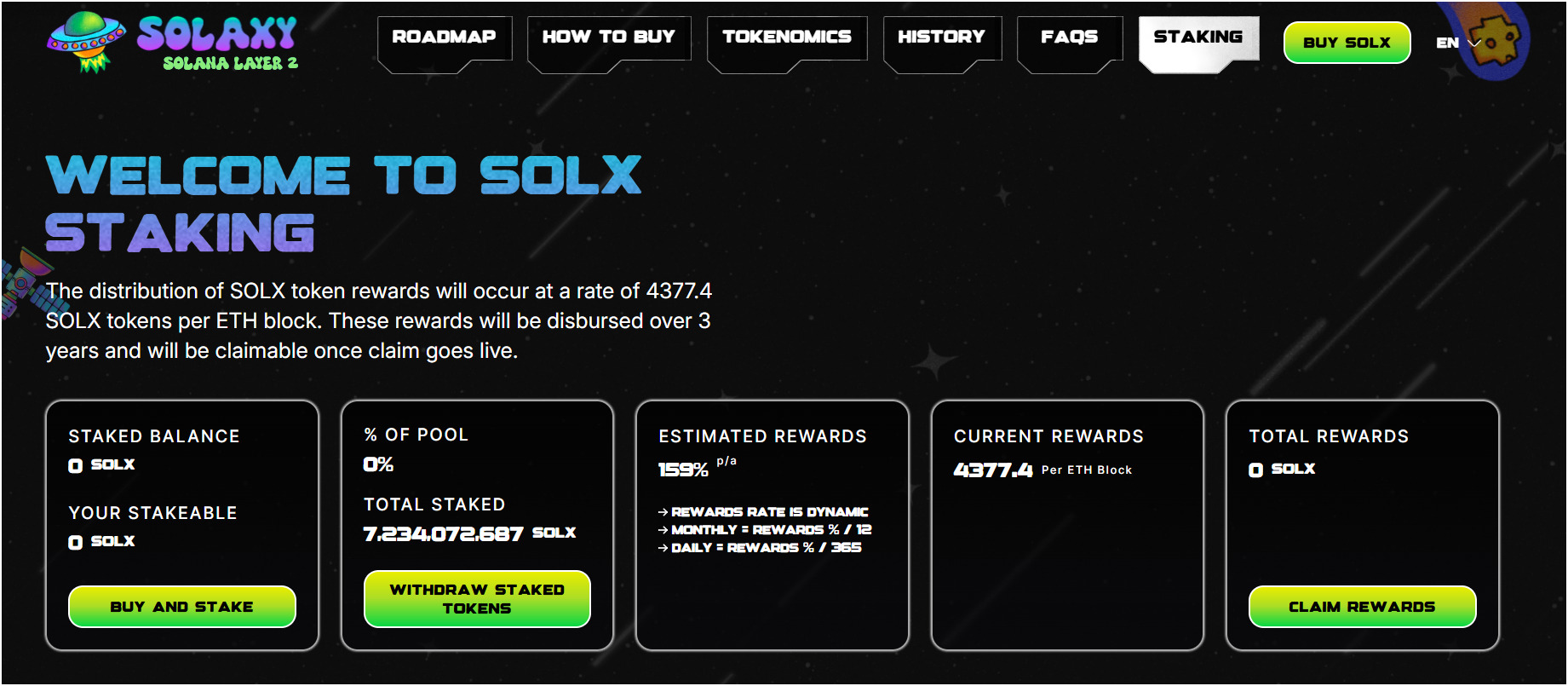

3. Solaxy

Solaxy is a Layer-2 blockchain developed on Solana that can enhance transaction speed and reduce fees on the network. The platform is Solana’s initial Layer-2 blockchain, mainly targeted towards decentralized applications and meme coin trading. It also has a native cryptocurrency, $SOLX, that you can use to manage fees, staking, and governance.

The token is currently in presale and has raised over $23 million in its public funding round. You can purchase these tokens at solaxy.io and stake right away on the platform. Currently, it offers staking of $SOLX tokens, and you will earn around 159% returns per year, and it gets lower depending on your tier and lock-up period. Plus, Solaxy also has plans to link with Ethereum’s DeFi network. However, it’s not live yet, but the presale indicates some very strong demand from the crypto investors.

Number of Supported Staking Coins: Solaxy supports one staking coin, $SOLX. The platform focuses on this token alone.

Pros of Solaxy

- Solaxy offers up to 375% staking returns yearly

- The platform cuts Solana’s transaction fees

- $SOLX token holders can also vote on future changes

- It raised over $23 million in presale funds, showing strong demand

Cons of Solaxy

- Solaxy stakes only $SOLX, no other coins

- The platform remains pre-launch currently

Join Solaxy now and earn passive income effortlessly—start staking today for maximum returns!

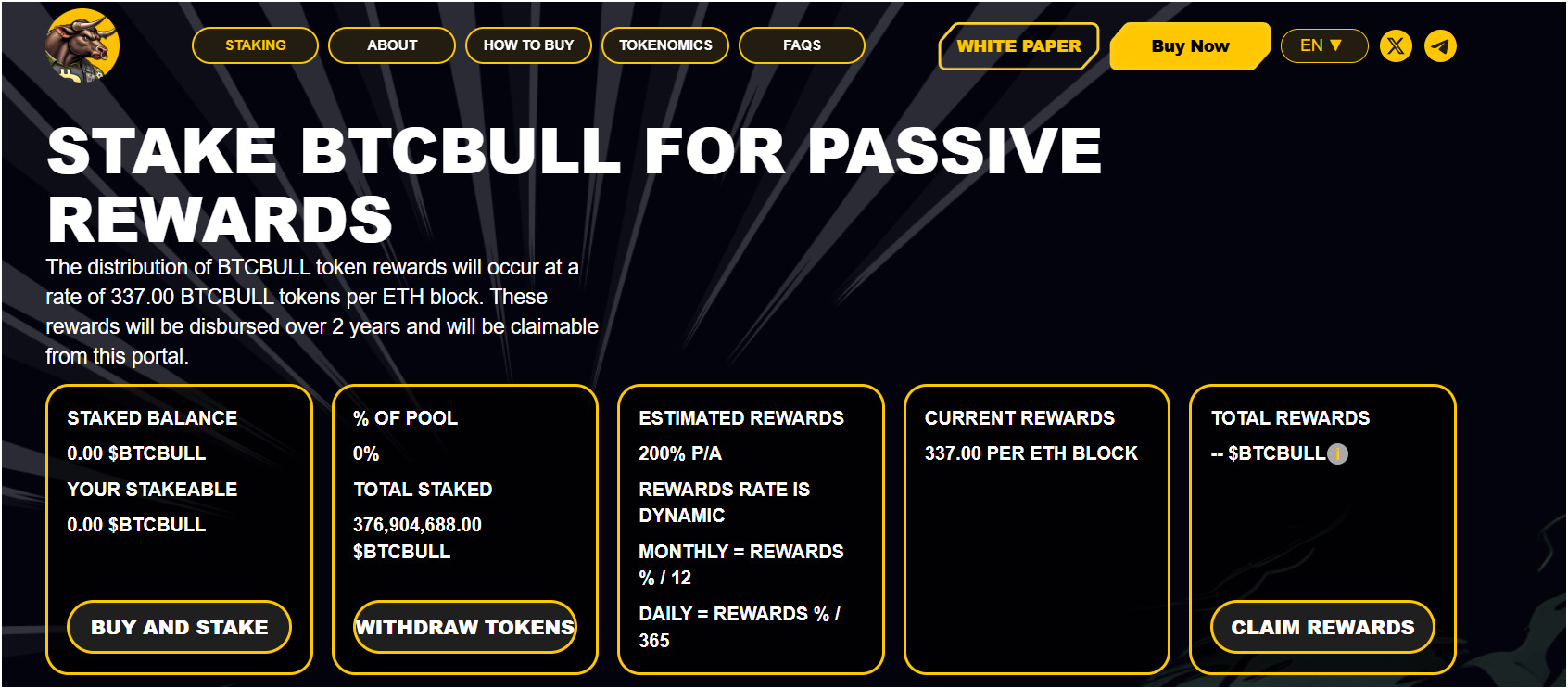

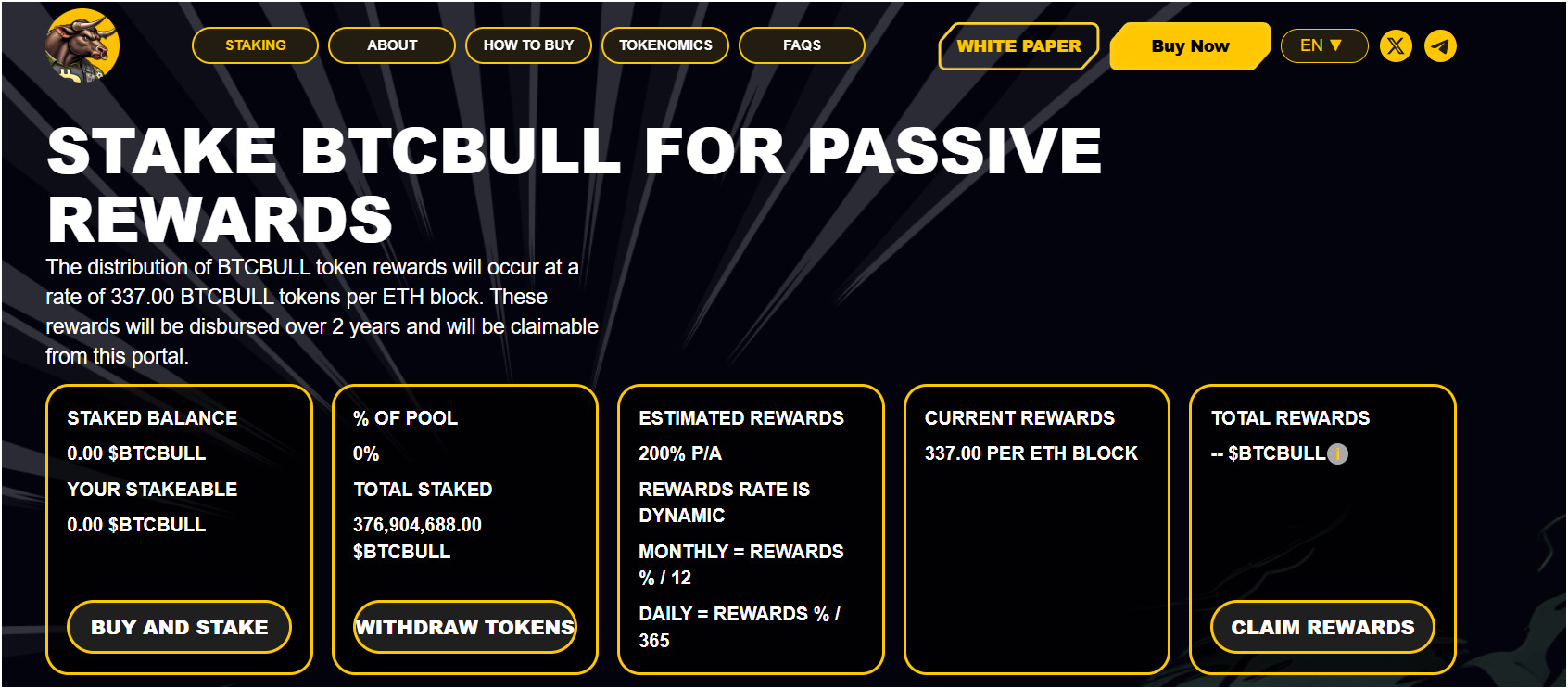

4. BTC Bull

BTC Bull is a cryptocurrency project built on the Ethereum blockchain. It brands itself as the “official Bitcoin meme coin”. It is designed to help Bitcoin’s price growth, and it is currently offering a presale token called $BTCBULL that will reward token holders as the BTC price reaches new milestones.

The project is mainly centered around a community-driven vision to support the rise of Bitcoin’s price to $250,000. It is currently in a presale state where you can purchase $BTCBULL using ETH using your DeFi wallet like MetaMask or Coinbase Wallet.

It has staking features where you can lock up your $BTCBULL tokens to earn high annual percentage yields (APY) during the presale and for two years afterward. Currently, it is offering over 200% staking rates. BTC Bull also promises other rewards for staking, such as Bitcoin airdrops when it reaches specific BTC price points like $150,000 and $200,000. There is also a token-burning mechanism that reduces supply by some percentage each time Bitcoin rises by $25,000.

Staking Rates: BTC Bull’s staking rate for its token $BTCBULL is around 200% annually.

Number of Supported Staking Coins: BTC Bull supports staking only for $BTCBULL tokens.

Pros of BTC Bull

- Airdrops when BTC hits $150,000 and $200,000

- Burns tokens at every $25,000 BTC increase to boost its value

- Higher staking rewards around 200% APR

Cons Of BTC Bull

- You can only stake $BTCBULL tokens

- APY rates may drop as demand increases

Ride the bull market with BTC Bull—stake your crypto today and boost your earnings!

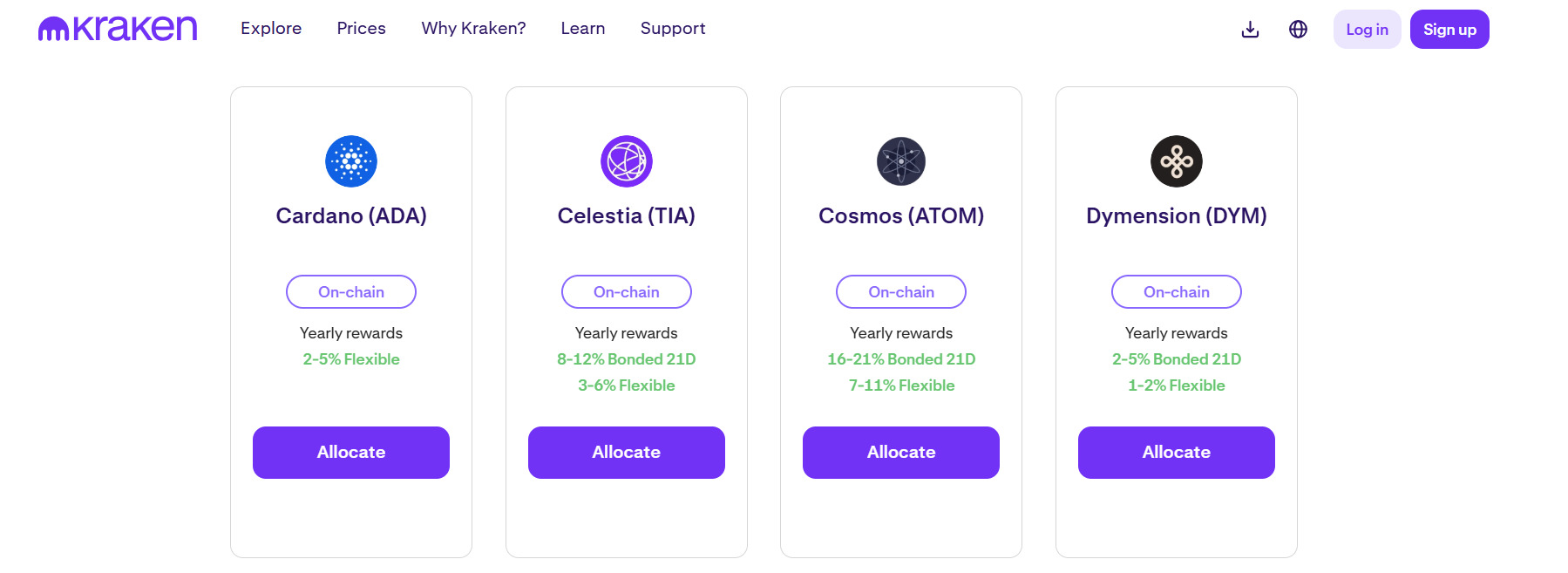

5. Kraken

Kraken is another top cryptocurrency staking exchange established in 2011 by Jesse Powell in San Francisco, California. The exchange is among the oldest in cryptocurrency space and has a very strong reputation for being secure and dependable. This staking platform operates in over 175 countries and supports more than 300 cryptocurrencies for you to buy, sell, and trade.

Kraken has two main platforms: Kraken Basic is for new users, and Kraken Pro is for more experienced traders. The pro version also offers lower fees in a maker/taker model and advanced features such as margin and futures trading with 50x leverage. The platform provides on-chain staking of 25 tokens, including ETH, DOT, ATOM, and more. Also, there is no bonding duration for the most flexible staking solutions.

You will earn staking rewards once a week, and Kraken also takes a commission of approximately 12% for bonded staking and 20% for flexible staking with unbonding times. It also provides opt-in yield products for Bitcoin (BTC), USD, EUR, and 4 other stablecoins.

BTC Staking Rates: Kraken offers Bitcoin staking under an “opt-in” option with 0.1% APY in flexible staking and 0.15% for bonded 30-day staking.

Number of Supported Staking Coins: Kraken supports staking for 25 on-chain cryptocurrencies, including Ethereum, Solana, and Cardano.

Pros of Kraken

- Kraken secures 95% of funds in offline cold storage for safety

- You can stake 25 coins with no bonding for flexible terms

- The platform offers up to 17% APY on select staking assets

- The exchange has never faced a major security breach since 2011

Cons of Kraken

- Kraken staking is only available in 37 U.S. states

- Advanced trading features like futures are not available in the U.S.

6. ByBit

Bybit is one of the best derivative platforms that offers crypto staking services. The exchange is the world’s second-largest by futures trading volume and now serves over 50 million users globally. It provides an ultra-fast matching engine and 24/7 customer service, and you also get multilingual support.

The platform offers “Bybit Savings” with flexible and fixed-term staking options. It supports over 190 coins for you to stake and earn passive income. Flexible Savings provides daily payouts with guaranteed APRs but low, whereas fixed-term staking offers high APY for periods ranging from 7 to 90 days.

There is also a launchpool to stake crypto assets like USDT and MNT and get free tokens from new projects launching on Bybit. The exchange also has other Earn products to earn passive income, such as liquidity mining, shark fin, and dual investment.

BTC Staking Rates: Bybit’s Bitcoin staking rates are 2.4% APR. However, if you want to stake more than 0.005 BTC, this rate drops to 0.4% APR.

Number of Supported Staking Coins: Bybit supports staking for over 190 cryptocurrencies. You’ve got popular picks like BTC, ETH, USDT, and even new altcoins like APT and SUI.

Pros of Bybit

- Bybit offers over 190 coins for staking with flexible terms

- Launchpool allows free staking with no lock-up for KYC users

- The platform ensures security with cold wallets and 2FA

- Bybit integrates advanced tools like TradeGPT

Cons of Bybit

- Bybit is unavailable in the UK and the USA due to regulations

- Recently faced a $1.4b hacking issue

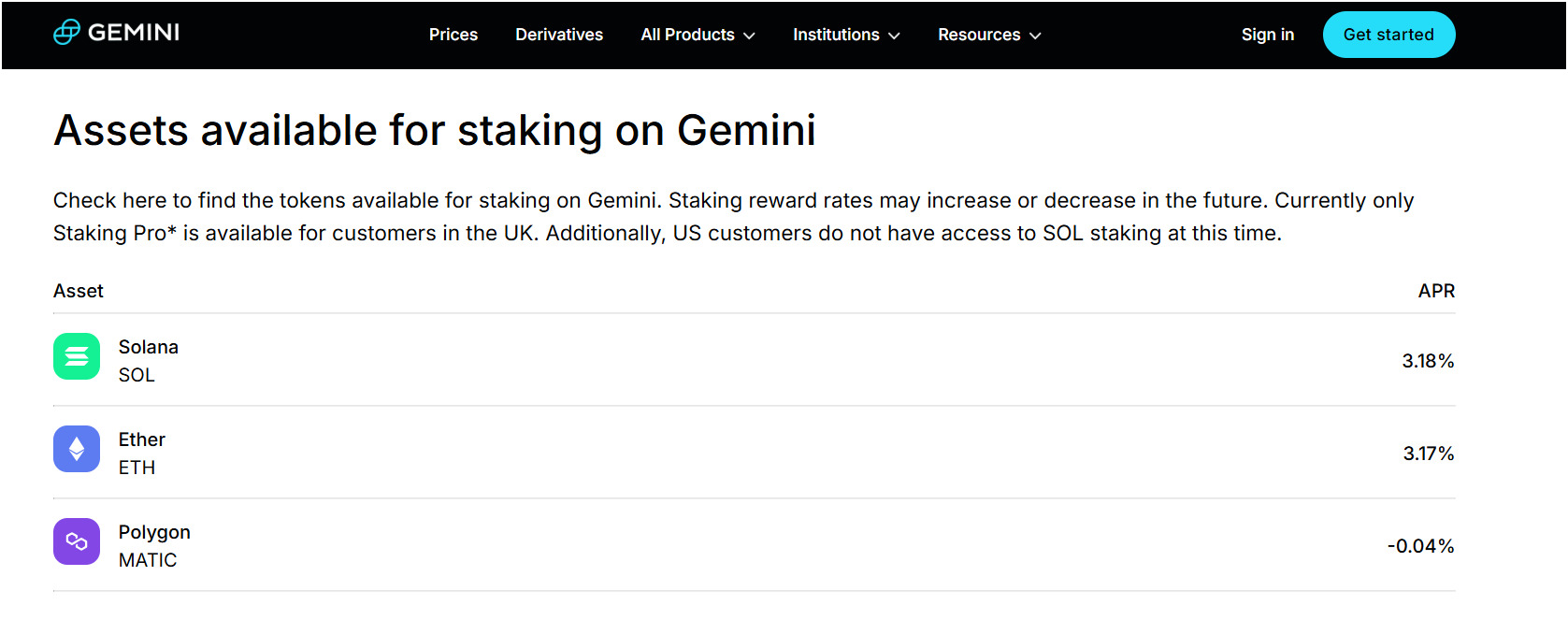

7. Gemini

Gemini is a regulated cryptocurrency exchange founded in 2014 by Cameron and Tyler Winklevoss. It is headquartered in New York and operates in all 50 U.S. states and more than 60 nations. Gemini has a reputation for being highly security—and compliance-focused, and it has licenses from the New York State Department of Financial Services.

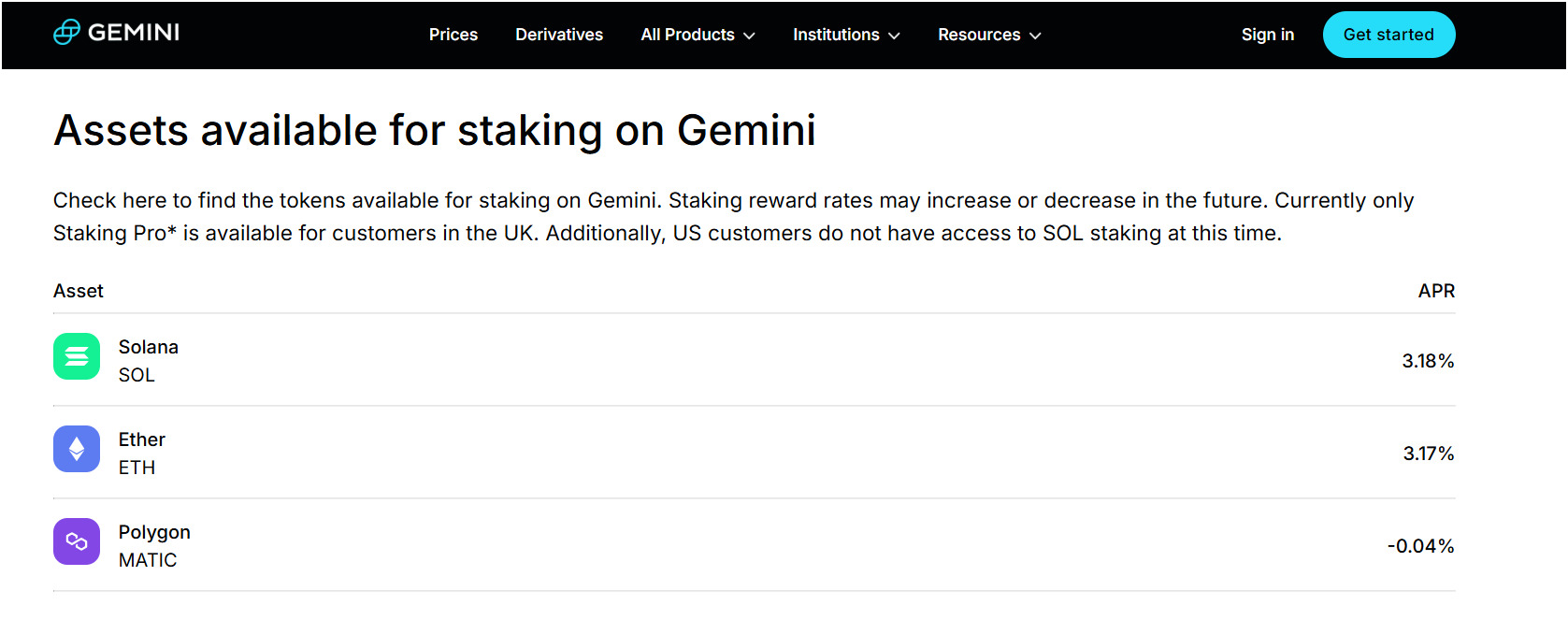

Gemini offers two types of crypto staking: Staking and Staking Pro. Normal staking is for new users with no minimum requirements, and rewards are shared from a pool. In this, you can’t track your staking position on-chain. While Staking Pro is for UK users only, and you can access on-chain information, including validator and reward payments. This is only for ETH staking with a minimum amount of 32 ETH. Gemini only supports 70 crypto assets for buying, selling, and trading, and you can only stake ETH, SOL, and MATIC for staking rewards.

Staking Rates: Gemini does not support Bitcoin staking, whereas ETH staking rates are 2.51%, SOL rates are 1.83%, and MATIC staking rates are -0.12 % per year.. However, staking rates may change and become positive someday, so please check the official Gemini website under the ‘staking’ tab for accurate rates.

Number of Supported Staking Coins: Gemini supports staking for 3 cryptocurrencies: Ethereum, MATIC, and Solana.

Pros of Gemini

- Gemini offers staking with no minimum amount required

- The exchange provides $200 million in custody insurance

- Gemini ensures high security with cold storage systems

- You get access to both beginner and advanced trading tools

Cons of Gemini

- The staking program supports only 3 cryptocurrencies

- UK users need 32 ETH minimum for Staking Pro

- US customers do not have access to SOL staking

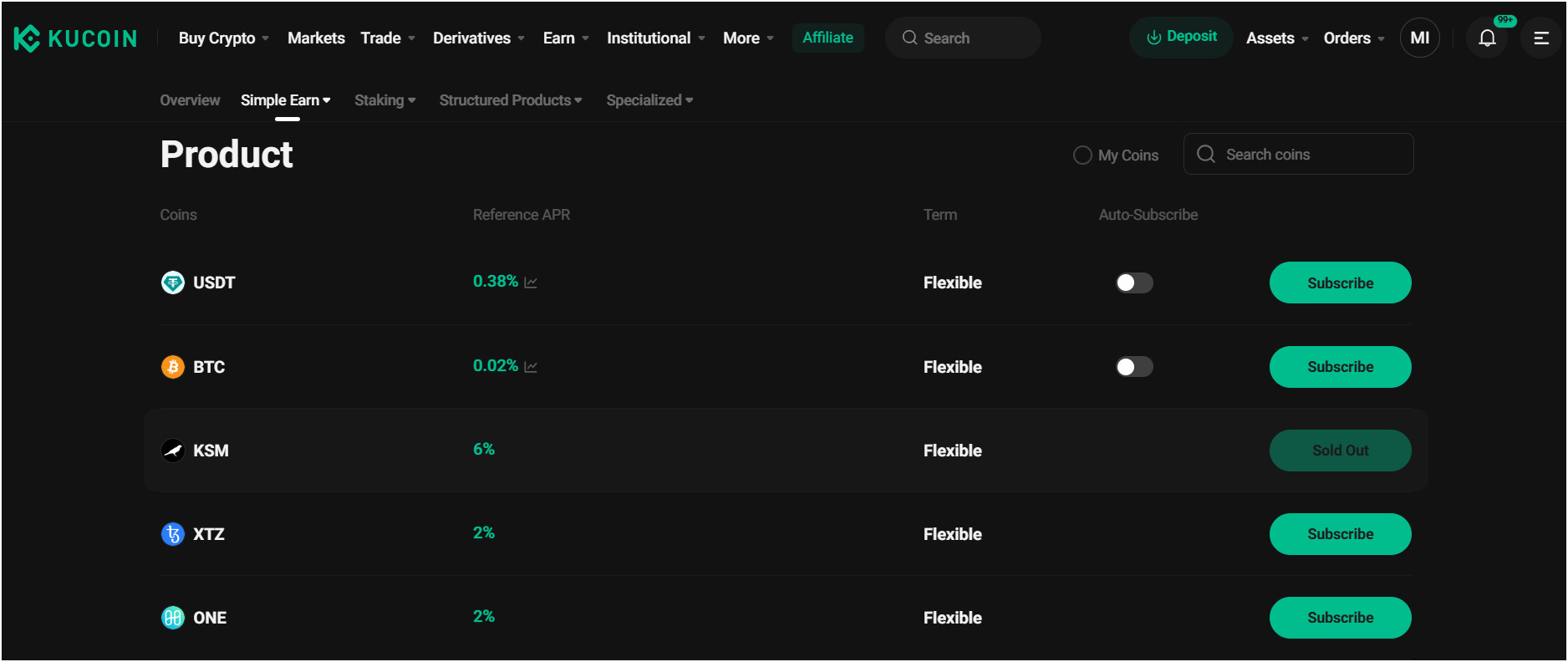

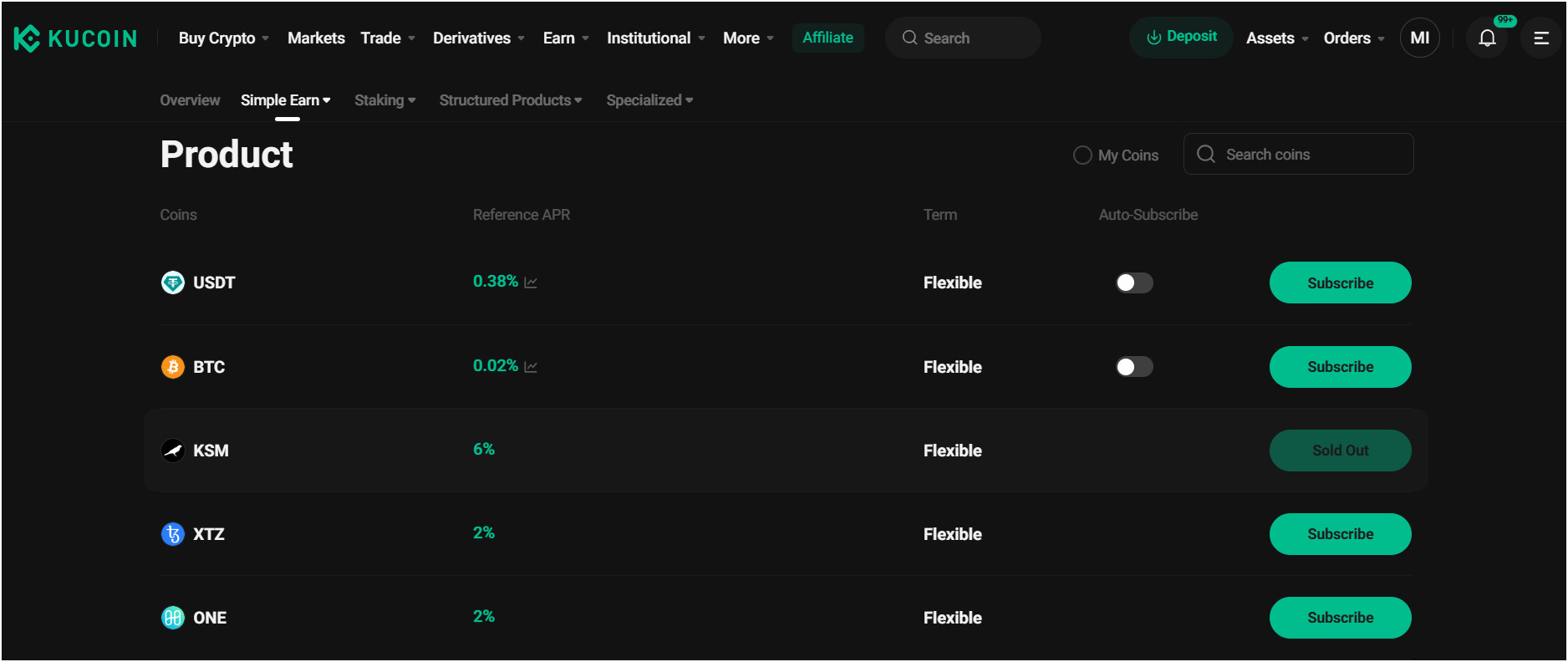

8. KuCoin

KuCoin is the best crypto exchange for high-staking rewards on altcoins. The exchange is best for trading a vast selection of coins, over 900 cryptocurrencies, and 1,290+ trading pairs.

KuCoin’s staking and earning products fall under the KuCoin Earn program. The exchange provides Simple Earn with adjustable savings, withdrawing at any time, and fixed staking, where the assets are locked in order to gain higher interest, such as 100% APR for some specific coins. There is also crypto lending on the site. Here, you can lend crypto assets like ETH for interest income. There are also various passive income products available, including KCS staking, shark fin, snowball, and double investment.

The platform supports both new and professional traders, with other features such as spot trading, futures with up to 100x leverage, margin trading, and trading bots for automatic strategies.

BTC Staking Rates: KuCoin’s Bitcoin staking rates are 0.02% APR, which is very low compared to other exchanges like Bybit.

Number of Supported Staking Coins: KuCoin supports staking for over 350 coins, including ETH, ADA, and KCS, and the platform regularly updates this list to include new staking options.

Pros of KuCoin

- The exchange provides staking for 350+ coins with flexible terms

- Trading fees start at 0.1%, dropping to 0% for VIPs

- KuCoin Earn includes lending with up to 10% interest rates

- The platform lists new altcoins early

- KCS staking gives users fee discounts and bonus rewards

Cons of KuCoin

- Customer support response time can be slow, frustrating users

- Bitcoin staking rates are very low

9. Crypto.com

Crypto.com is another highly regulated and licensed crypto staking platform. The exchange has over 10 million crypto users worldwide and offers a variety of crypto services, including trading, staking, and a cashback offering Visa card. It supports more than 350 cryptocurrencies and also offers a separate Crypto.com App for mobile users.

The Crypto.com Earn program allows you to earn as much as 19.07% annual percentage yield (APY) by holding your crypto in flexible periods and certain fixed periods with 1-month or 3-month duration on more than 30 coins that include stablecoins such as USDT. Additionally, you can stake CRO tokens to enjoy some additional benefits, such as extra staking rewards and lower trading fees.

Staking Rates: Crypto.com does not offer Bitcoin staking, but you can stake other popular coins like ETH with 2.3% APR, DOT with 15.47% APR, and ADA with 3.06% APR.

Number of Supported Staking Coins: Crypto.com supports 30+ crypto assets for staking rewards, including ETH, ADA, CRO, AVAX, SOL, SEI, and more.

Pros of Crypto.com

- Crypto.com supports over 350 coins for trading

- You earn up to 19.07% APY on 30 staked tokens

- The Visa card offers 1-5% cashback in CRO rewards

- The Crypto.com DeFi Wallet gives you full private key control

Cons of Crypto.com

- A limited number of supported coins for staking compared to other exchanges like Binance

- It is not available in New York state.

What is Crypto and Bitcoin (BTC) Staking Service?

Crypto and Bitcoin staking service is a way for crypto investors to earn rewards by holding and supporting a blockchain network. In brief, you have to lock up some of your cryptocurrencies, like Ethereum or others, to help keep the blockchain network secure and running smoothly. Here, you’re also assisting the blockchain by validating transactions and keeping the blockchain running when you stake your coins.

This is how it is done: instead of simply having the crypto stored away in a wallet, you must put it away in a staking service offered by any wallet or exchange. And by doing so, you pledge that you will not sell or transfer those coins for a certain length of time, and for keeping your promise not to do that, you are rewarded with extra coins.

Also, Bitcoin staking is not well-known as it works with a completely different protocol, which is Proof of Work, but there are some services where you can stake your BTC indirectly using special programs.

How does crypto staking work?

Crypto staking works by locking up coins in a blockchain network to help it run smoothly and securely. It happens only on proof-of-stake blockchains, like Ethereum or Cardano, that do not use power-consuming mining, like Bitcoin.

PoS mainly depends on network validators, which are computers used to check and sign transactions. You can easily become a validator by staking a minimum quantity of coins; for example, in the case of Ethereum, you need 32 ETH to become a validator.

The crypto staking process starts when a person stakes coins through a wallet or exchange like Binance. The coins are then secured in a smart contract. Now, the blockchain will select random validators from the pool of stakers to complete transactions and add to the ledger in the blockchain.

What are the best platforms to stake Bitcoin (BTC) and crypto?

The best platforms for staking Bitcoin and crypto are Binance, Coinbase, Solaxy, BTC Bull, Kraken, Bybit, Gemini, KuCoin, and Crypto.com due to their high-security measures, high staking rates, multiple supported coins, and being easy to use for beginners.

What are the Benefits and Risks of Crypto Staking?

Benefits of crypto staking

The benefits of crypto staking are earning passive income, securing the blockchain network, being easy for beginners, having fewer energy costs compared to mining, and growing investment over time with compounding.

- Earning a passive income: Crypto staking means you need to lock up your cryptocurrency to validate a blockchain network and then earn your rewards. For instance, Ethereum staking will earn you around 3-5% annual percentage yield (APY).

- Secures blockchain: Your staked coins are required to confirm transactions on proof-of-stake networks. This is mandatory for network security and makes it more decentralized and public.

- Easy for a beginner: The best crypto staking platforms, such as Binance or Coinbase, do the staking for you, and you don’t need to know any technical parts. You just simply deposit your coins, and they do the technical bit, paying you rewards, generally monthly or weekly.

- Less energy costs: Staking consumes much less electricity than PoW assets like Bitcoin. That’s why Ethereum’s transition to proof-of-stake in 2022 reduced its energy consumption by 99.95%.

- Grow your investment: Many crypto exchange platforms support auto-investing of your rewards daily or weekly, and hence, interest gets compounded over the long term when you reinvest.

Risks of crypto staking

The risks of crypto staking are the lock-up period, crypto market volatility, third-party hacking risk, and smart contract risks.

- Lock-up periods: As you know, crypto staking involves locking in your assets. There are both flexible and fixed terms staking, but if you want high rewards, you need to choose fixed term staking with lock-up periods. You can’t sell or trade during this time.

- Market is volatile: Crypto prices are very volatile compared to traditional stock prices, as it can wipe out over 30% of coins’ market cap in a single day. So, if you stake 1 Ethereum at $2,500 and its price drops to $1,500, your rewards might not be able to offset the losses.

- Depend on third parties: Crypto staking using exchanges like Coinbase and Coinbase carries risk. If they get hacked or go bankrupt, you could lose everything, as seen with FTX in 2022.

- Technical risks: Smart contract bugs or network failures can wipe out your entire funds.

Is crypto staking worth it?

Crypto staking is worth it if you’re okay with some risks and want to earn extra coins without much effort. You will easily earn 5-10% APR on popular crypto assets and, hence, will grow your wealth over time. However, certain risks, like exchange hacking or smart contract vulnerabilities, need to be considered carefully.

How to Start Staking Crypto?

To start staking crypto, you need to choose a crypto staking platform, set up an account and complete KYC, deposit or buy crypto, and lastly, stake your crypto to earn rewards.

Step 1: Select a Crypto Staking Platform

First, you must select a trustworthy and reliable staking platform for your cryptocurrency. We recommend Binance as the best platform for staking crypto. It is a great option because it’s the largest crypto exchange in the world, with a straightforward and secure staking process and some decent rewards.

The platform is also trustworthy and very popular, and it also supports 300+ cryptocurrencies for staking. Also, you can check our in-depth Binance review for more information about the exchange.

Let’s see how to start staking your crypto with Binance and enjoy exclusive rewards—sign up now and unlock special bonuses.

Step 2: Set up an Account and KYC

You can start by going to the Binance exchange and clicking the “Sign Up” button at the top of the home page. Now, enter your email and a very strong password, and also confirm your account using the verification code sent to your email. You can also use our Binance referral code during registration to get a free $100 crypto sign-up bonus.

Binance will ask you to submit your KYC verification details to maintain security and comply with regulations. You need to provide your name, birth date, and address, and also upload an official ID, such as a passport or driver’s license, and you may also be asked to undergo facial recognition.

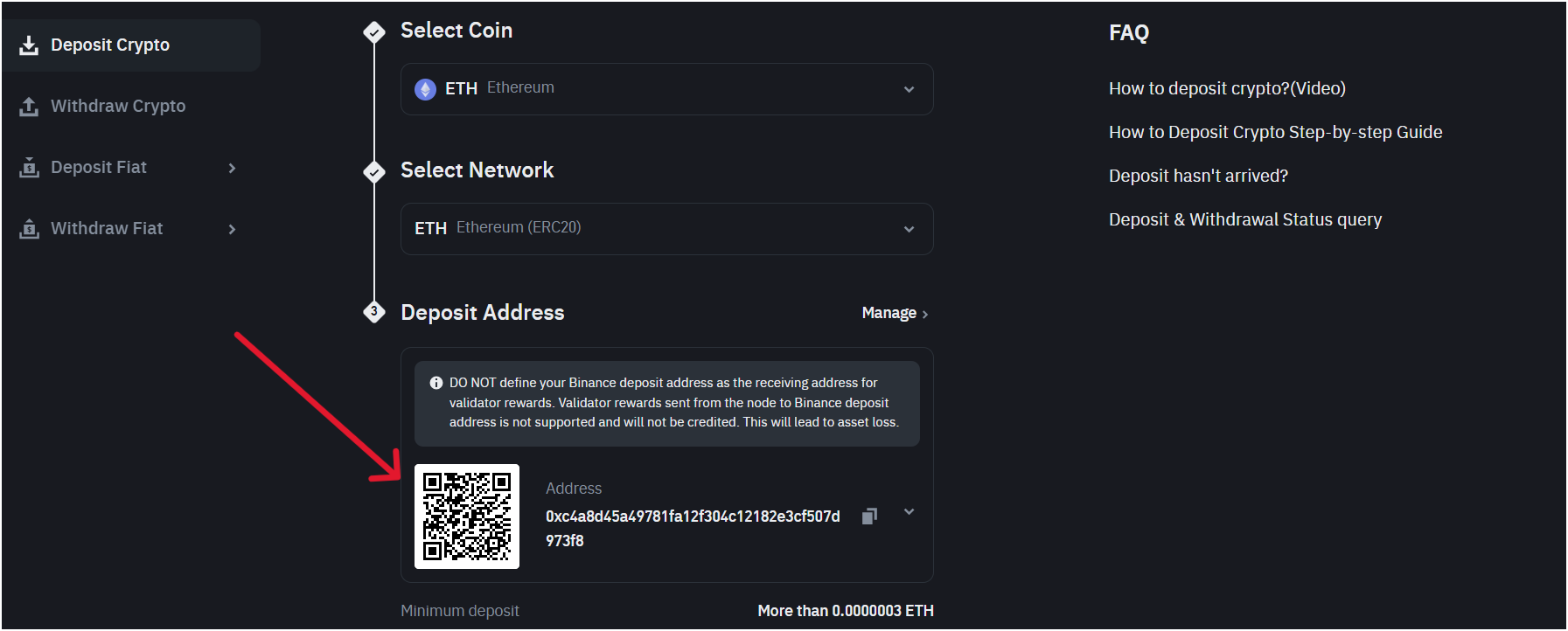

Step 3: Deposit Crypto or Buy Crypto to Stake

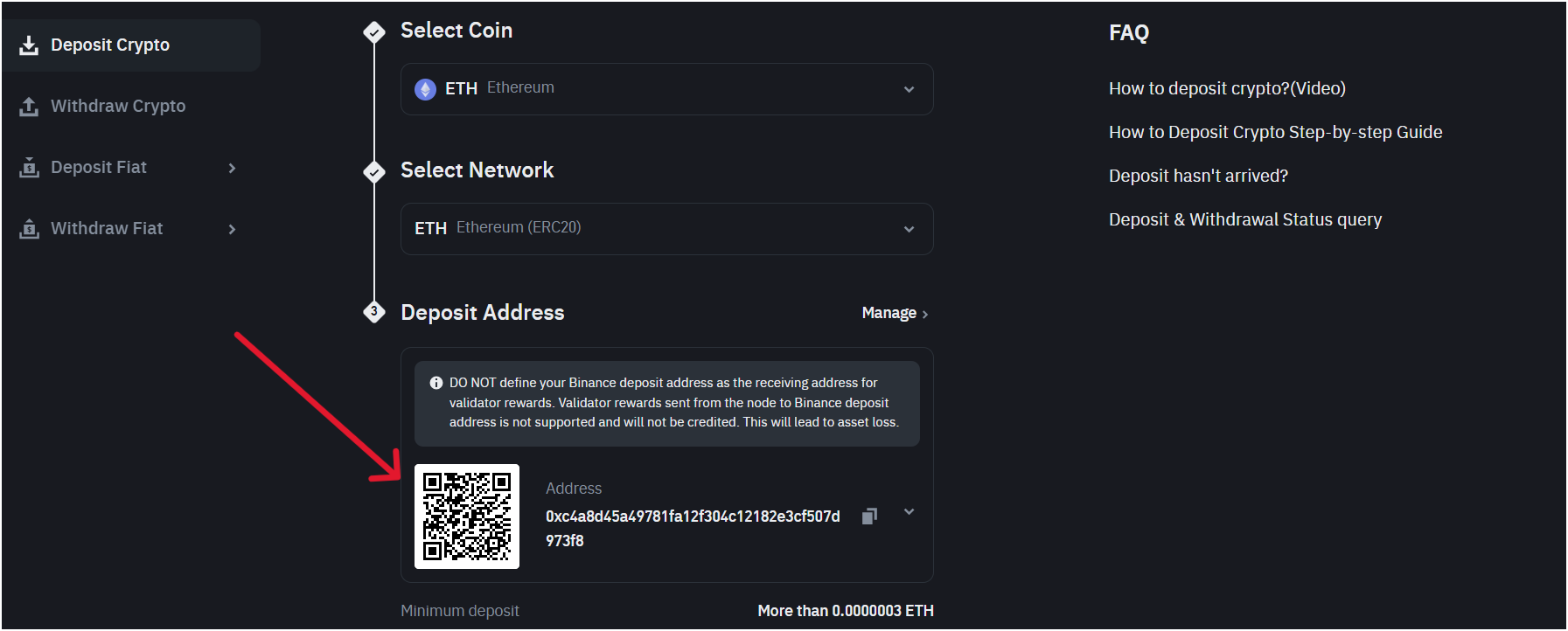

Now, you will require some crypto assets in your Binance account to stake them. Go to the “Wallet” section and then select “Deposit” and select a cryptocurrency to deposit, such as ETH. Here, Binance creates a wallet address for you to deposit, and you must copy it with care. Now, transfer ETH from another wallet to this address.

Alternatively, you can also buy crypto directly. For that, you need to proceed to “Buy Crypto” on the homepage, click “Credit/Debit Card”, pick your asset, input your amount, and enter your card information. And complete the purchase.

Step 4: Stake Your Crypto and Earn Rewards

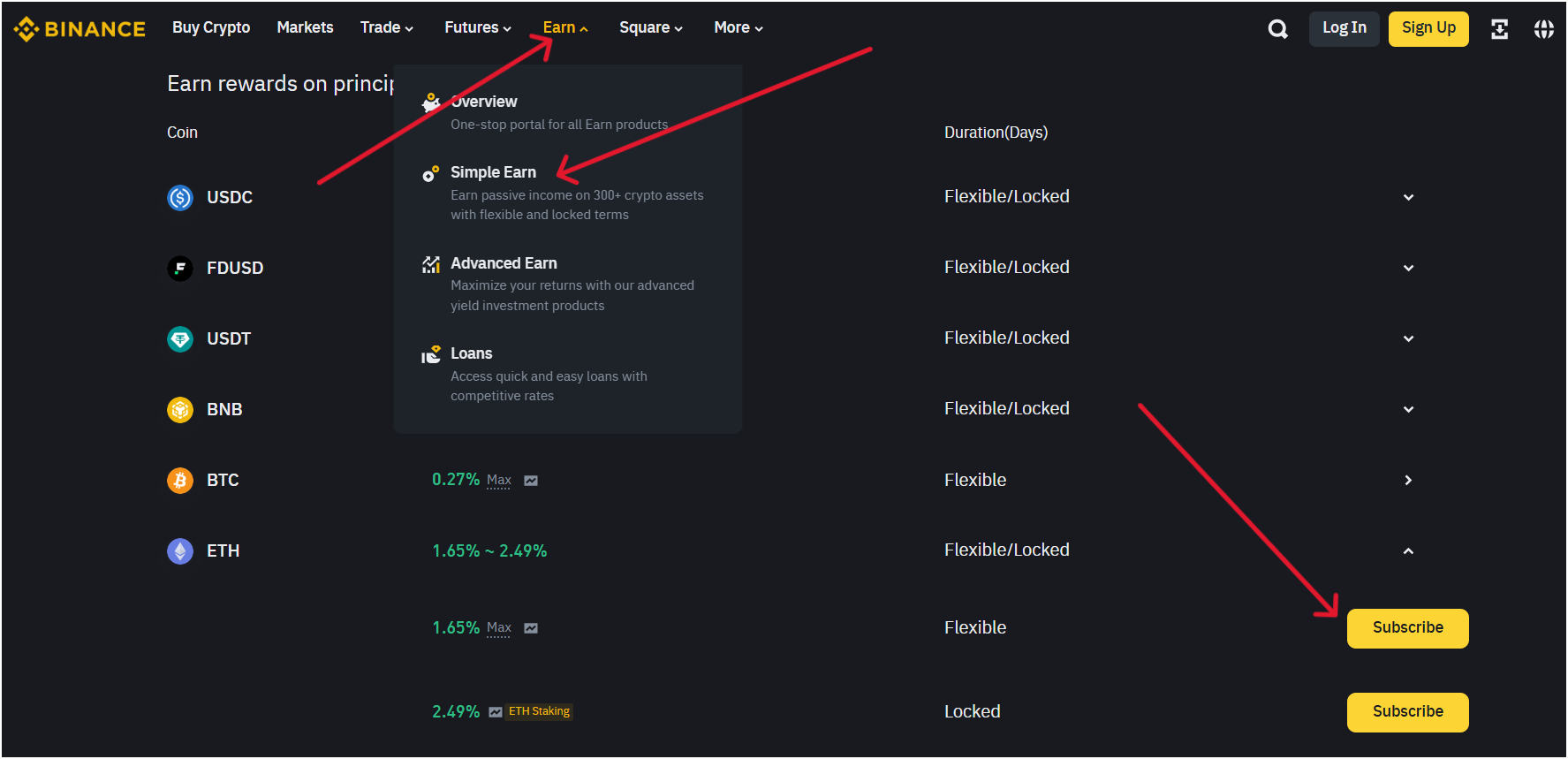

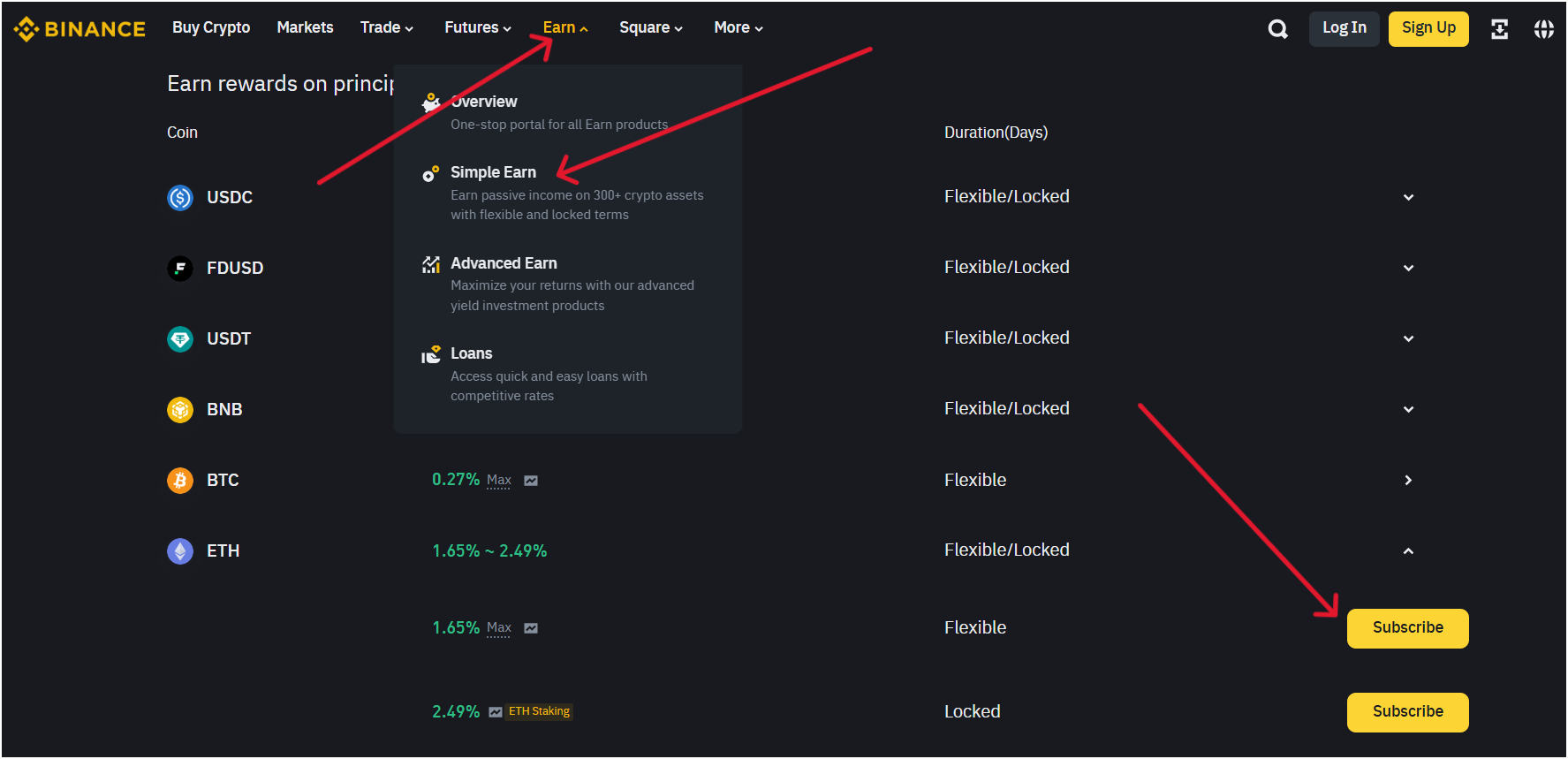

To stake cryptocurrency on the Binance exchange, you need to go to “Earn” from the homepage, then click “Simple Earn”. Here, you’ll see many options like Flexible Staking or Locked Staking. Pick your asset, review the annualized percentage yield (APY) and lock-up terms, like 30 days for Locked Staking. Now, enter the amount and confirm.

How to Choose the Best Places to Stake Your Crypto and Bitcoin (BTC)?

To choose the best places to stake your crypto and Bitcoin (BTC), you need to consider factors such as security measures, staking rates, supported coins, types of staking, staking fees, ease of use, and reputation and reliability.

- Security Measures: Security is the #1 priority when you choose a crypto-staking platform. You want a place that must keep your crypto safe from hackers and phishing attempts. The best crypto staking platforms, like Binance and Coinbase, use very strong security measures that include 2FA, insurance funds, and cold storage. Also, you can check if the chosen platform has any history of hacks. Bybit had a $1.4 billion hack recently in 2025, but it covered losses for users, and the exchange is also 1:1 solvent, which shows reliability. So, you need to pick a platform with a solid track record and the best security features.

- High Staking Rates: Staking rates determine how much you are going to earn from your crypto staking. Each platform offers different annual percentage yields (APYs), and these can vary by cryptocurrency and your staking period. Binance currently offers up to 0.27% APY on Bitcoin staking, while some exchanges only support proof of stake coins and do not offer BTC staking. All you need to do is compare these crypto staking rates, but don’t chase super high numbers like 50%, they often come with high risks like scams or unstable coin prices.

- Supported Coins: The number of supported cryptocurrencies really matters because not every platform lets you stake Bitcoin or other coins directly. As you know, Bitcoin uses proof-of-work, so staking it mainly involves using wrapped Bitcoin (WBTC) on proof-of-stake chains like Ethereum. Also, Binance lets you stake over 300 coins, including BTC, but some other exchanges like Crypto.com offer staking for only 30 coins. You must choose a staking platform that supports the coins you own. Plus, there are some exchanges that limit certain staking services in the U.S., so verify carefully.

- Types of Staking: You need to choose a platform that offers both flexible and fixed-term staking services, or it must match your locking period requirements. You need to decide if you’re okay with waiting or want your money free to withdraw anytime.

- Staking Fees: You must check the platform with lower fees or even zero fees. Mainly, crypto platforms charge fees for managing your staked assets. Coinbase takes a 25% cut of your staking rewards, but on the other hand, Bybit never takes staking fees on its 190+ supported coins. So, you should calculate how these charges impact your earnings and whether they are really worth it or not. Also, if you are looking for a low-fee platform, you can check out our detailed guide on the best zero-fee crypto exchanges.

- Ease of Use: The staking platform must be easy to use for beginners. You need an exchange that allows one-click staking and unstaking services. Plus, there must be a dashboard to track rewards easily and withdraw them or auto-invest for compounding, if needed. If the platform has a mobile app for you to stake crypto instantly, it’s another convenient feature for beginners.

- Reputation and Reliability: The chosen exchange must be trustworthy and also look for regulatory compliance. Also, you need to choose a platform with good customer support. Plus, check its hacking history. Even if it gets hacked, check how it manages to recover user assets. If the exchange manages hacks in good faith, it’s always a good sign of its reliability. For example, Bybit and Binance both faced large hacks in the past but are the largest crypto exchanges in the world today.